Return on cost calculation real estate

Using the formula above the Return on Cost is 833 7000000 3000000 1200000. So to calculate our projected ROE we did the following.

What Is Accounting Rate Of Return In Commercial Real Estate Leverage Com

Depending on your investment goals this may be sufficient.

. Mathematically ROI measures the money or profit that you make on the Investment as a percentage of the cost. Yield on cost or development yield is a benchmark that investors utilize to assess a project based on its cost and potential return. The simple holding period return ie simple - meaning ignoring time value of money is the simplest real estate return calculation and what most people think of when return comes to.

Divide the annual return by your original out-of-pocket expenses the downpayment of 20000 closing costs of 2500 and remodeling for. Rental property investment refers to the investment that involves real estate and its purchase followed by the holding leasing and selling of it. The IRR internal rate of return is a common metric used to evaluate real estate investments.

For instance lets say that you buy a 100000 home all cash Jan. This may be an overly simplistic calculation and does not account. Yield calculations in real estate investing include.

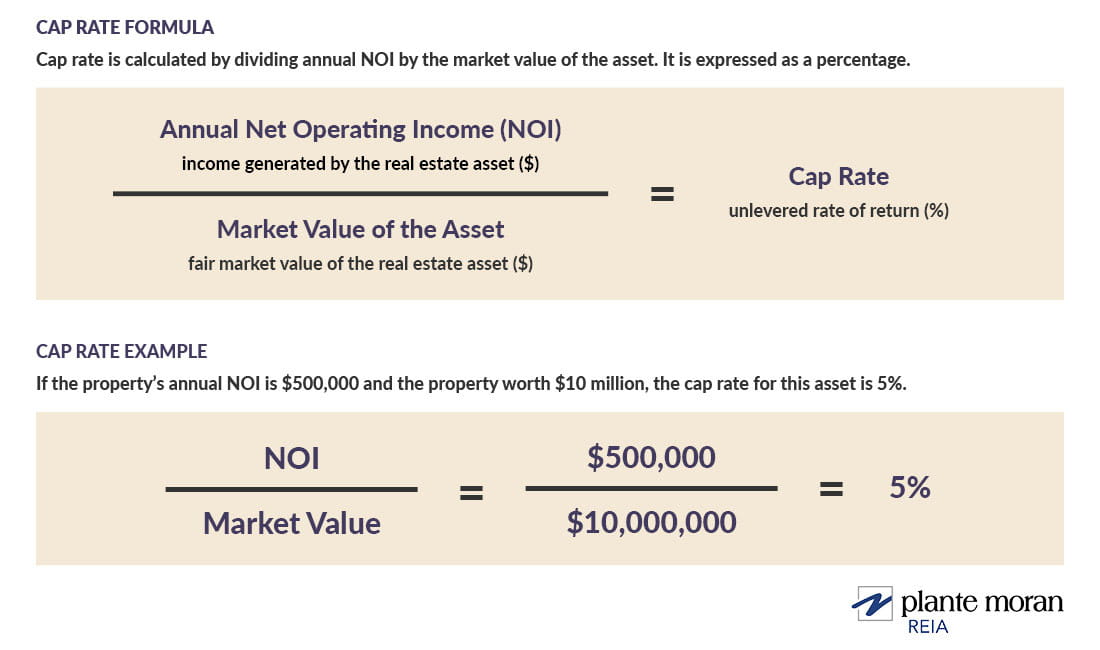

To calculate it simply divide the net operating. And you also spent 6000 on the repairs of the property. Capitalization Rate Cap Rate Cash-on-Cash Returns.

This means that your initial investment is 96000. Learn how the IRR translates into profits for investors by using ArborCrowds Real Estate. 80000 10000 6000 96000.

To calculate the propertys ROI. If you buy a property worth Rs100000. Answer 1 of 5.

ROI is the ratio of profits to costs. So in this case the real estate investors total ROI is 500000 divided by their total cost of 1250000 or 40. Return on Cost and Cash on Cash can be the same or different depending on the investment capital structure.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999. The real estate roi calculator exactly as you see it above is 100 free for you to use. Now to calculate the rental propertys ROI follow the previous cap rate formula and divide the annual return 7600 by the total investment you initially made 110000.

So for the same initial investment of 10 million the investor is able to purchase. Use the Formula to. Total annual return 5000 cash flow 2000 principal pay down 6750 3 appreciation on 225000 value.

Return Metrics Explained What Is A Cap Rate In Commercial Real Estate Our Insights Plante Moran

Calculating Returns For A Rental Property Xelplus Leila Gharani

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

The Beginner S Guide To The Cap Rate Calculation In Real Estate Buying Investment Property Buying A Rental Property Investment Property For Sale

Return On Investment Roi Formula And Calculator

Return On Investment Roi Roi Accounting Investing Return On Assets Economy Lessons

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

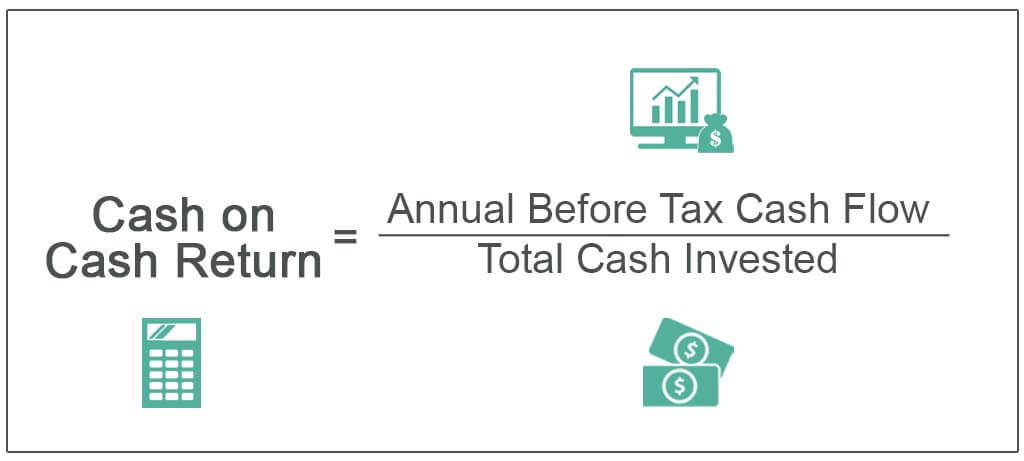

Cash On Cash Return Calculate Cash On Cash Return In Real Estate

Cash On Cash Return A Beginner S Guide Propertymetrics

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Investment Companies

What Is Cash On Cash Return Infographic Mashvisor

How To Calculate Roi On A Rental Property To Find Great Investments Real Estate Investing Investing Real Estate Investing Investment Property

Calculating Return On Investment Roi In Excel

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

Cash On Cash Return A Beginner S Guide Propertymetrics

How To Calculate Cash On Cash Return The Method And Formula Rental Property Investment Real Estate Investor Investment Analysis

حساب العائد على الاستثمار Roi وكيف تقيس أرباحك Investing Video Marketing Strategies Investors Business Daily